Business Loan Default Attorneys

A business loan default occurs when a company fails or struggles to meet the terms of the loan agreement it has with its lender. In today’s marketplace, it is all too common for businesses to take out loans in order to make ends meet. By using short-term or long-term loans, local businesses have used debt to fund their day-to-day business needs, and managing these financial obligations is a daily struggle. Sometimes these payments can be overwhelming. This is especially true for those companies who have seen recent changes to their businesses.

Your Business is Not Alone

As many people are intimately aware, the business community has had to remain flexible over recent years. Whether it is fluctuating prices in underlying real estate, the sluggishness of the economy, or amendments to current laws, local business owners have had to adapt quickly to changes in the marketplace. These unforeseen factors have put pressure on many in the area, leading to a rise in business loan default. If this story sounds familiar, you are not alone. Businesses have had to adjust to new realities, and this has led to many successful companies having to deal with the possibility of a business loan default.

There Are Options When Facing Business Loan Default

More than likely, if you are facing business loan default, your company is dealing with even larger financial problems. That said, you don’t have to let all of your hard work go to waste. Your company has options when deciding its next steps.

Apart from extreme measures for freeing up cash flow, such as selling off assets or laying off employees, the most straightforward option is to work out a compromise of terms with your lender. Our attorneys negotiate for large reductions in interest AND principal of the business loan. We help clients settle their loans for a fraction of the balance the lender says is owed – all without bankruptcy. It is always best to seek professional advice before electing this option, because creditors aren’t always willing to come to the table to compromise. It is particularly important to have a lawyer with experience representing your interests in business loan negotiations.

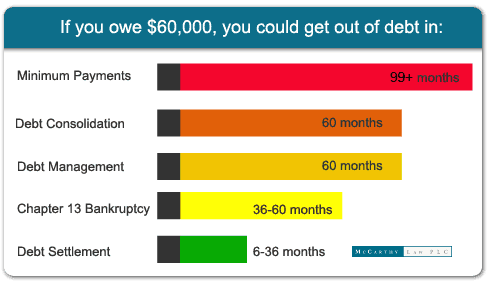

Another option is to go into a bankruptcy proceeding or reorganization. However, with Chapter 13 bankruptcy in particular, you will likely end up paying back most of the debt and it can take up to 5 years. With an attorney negotiated debt settlement, on the other hand, you can settle the debt for fractional amount in as little as 6 to 36 months. Here’s a comparison chart of the different methods for resolving business debt:

Let Us Help You Develop A Plan

If you are facing a default on your business loans, it is important to develop a plan that works. Because a loan default usually carries swift penalties (fees, higher interest rates, poor credit score, etc.), it is exceedingly important to act quickly. If you are unsure where to start, you are not alone. The attorneys at McCarthy Law have experience helping business owners like you come up with a strategy that best meets their business needs. If you would like to speak to one of our attorneys about your company’s debt, contact us today to set up a FREE consultation and put our experience to work on your business loan problems.