Creating a Successful Debt Management Plan

There are a lot of ads for debt relief services. They all claim to have the solution to your debt problems, but never really explain how they work. The truth is each person has a unique story behind his or her financial situation. This story and the life circumstances you find yourself under when you decide to address your debt will determine which option is best for you.

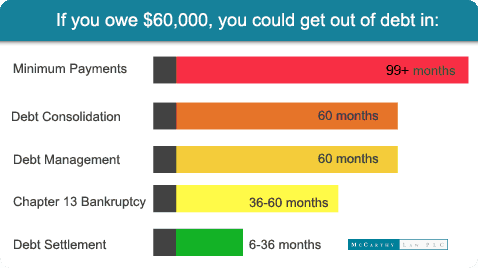

Whether it is a Debt Management Plan (DMP) or a Debt Settlement Plan (DSP), if it’s a legitimate company there should be a free consultation and evaluation of your debt before you choose to enroll. An increased understanding of your debt is a crucial part of both programs. Here is a chart that gives a quick comparison between the different approaches to eliminating debt:

Here are some simple questions you should ask yourself before you commit to a particular debt management plan.

Can You Afford to Pay Back All of Your Debt?

If the answer to this question is YES, then a debt management plan may work for you. In a DMP you usually receive a reduced interest rate and make only one monthly payment, but it will still result in the full amount of your debt coming out of your pocket. You also have to pay fees to the debt management company in addition to your debt. For most with serious debt issues, a DMP doesn’t make sense.

If the answer is NO, then an attorney negotiated debt settlement may be a better option for you. A negotiated debt settlement is one of the few alternatives to bankruptcy where you do not pay the full amount of your debt. In a debt settlement your attorney will negotiate the pay-off amount with each creditor. In those negotiations, the focus is on the actual principal amount of the debt. A skilled negotiator can reduce your payoff to a fraction of the original balance. And a licensed attorney can defend you if you are sued.

How Well Can You Self Manage?

As much as a debt management plan claims to be managing your debt, it also requires you to self-manage. In a debt management plan you CANNOT miss a payment or pay less than the amount agreed upon. If for any reason your payment is late or short, your creditor can drop out of the program and demand the entirety of your debt. Many people are in financial difficulty because they have trouble making payments on time, so they end up dropping out of DMPs because of this strict schedule.

A well run debt settlement program requires some self-management, but the whole idea is to pay the creditor much less than the creditor wants. The payment schedule is made based on your financial capabilities. In a debt settlement program you are able to save up a lump sum amount to pay in full settlement of your debts, usually a fraction of the original balance. In doing so, you eliminate the debt and avoid bankruptcy.

What Will Happen in Your Life in the Next 3 to 5 Years?

This is generally how long a debt management plan takes to complete, so if you enroll in a DMP you better have the answer to this question, or a large backup savings account. While you are enrolled in a DMP you are required to close all of your credit accounts and you are no longer allowed to open any new credit.

A debt settlement program allows you to keep your accounts open while enrolled. While it is highly recommended you do not increase your debt while enrolled, if an emergency happens you will not be dropped from the program. Not to mention you are less likely to be placed in a financial emergency during your participation because a debt settlement program usually lasts only 6 months to 36 months and you end up paying a lot less money.

Learn More About Debt Management Plans and Debt Settlement Plans

These questions are meant as a brief introduction to deciding how to best address your debt. Understand more information on selecting the right debt management plan for you. To get a full explanation of your options so that you can make the right choice for you and your family, contact McCarthy Law today for a free consultation and case evaluation.